outdoorshop.site

Prices

Kraken Visa Card

Seattle Kraken®. Vancouver Canucks®. Vegas What's the difference between the Discover it® Cash Back credit card and the NHL® Discover it® credit card? Learn about WaFd Bank's debit and Seattle Kraken debit cards. Visit our FAQs page for more information. Thank you for reaching out, u/Historical_Button! Yes, US clients can indeed use debit or credit cards to purchase crypto on our platform. For credit card TTY support 24/7: Replace Your Debit Card. BECU members can replace an existing BECU debit card anytime. No need to call or make a. We also have Cash-to-Card kiosks conveniently located throughout the park where you can transfer your cash (free of charge) to a Visa prepaid debit card. Kraken Fitness - The Best Personal Training In Burnaby, British Columbia Update Credit Card. ×. Client Case Studies · Careers · Request To Hold Membership. But can you buy crypto with a credit card? Yes, you can. Most renowned crypto exchanges like Binance, KuCoin, or Kraken allow users to purchase crypto using a. Yes, you can buy cryptocurrency with your Visa or MasterCard credit cards on Kraken. However, credit card purchases come with a % Instant Buy fees on Kraken. Check out the Seattle Kraken sponsored debit card at WaFd Bank and enter the sweepstakes to win suite tickets to a hockey game in Seattle! Seattle Kraken®. Vancouver Canucks®. Vegas What's the difference between the Discover it® Cash Back credit card and the NHL® Discover it® credit card? Learn about WaFd Bank's debit and Seattle Kraken debit cards. Visit our FAQs page for more information. Thank you for reaching out, u/Historical_Button! Yes, US clients can indeed use debit or credit cards to purchase crypto on our platform. For credit card TTY support 24/7: Replace Your Debit Card. BECU members can replace an existing BECU debit card anytime. No need to call or make a. We also have Cash-to-Card kiosks conveniently located throughout the park where you can transfer your cash (free of charge) to a Visa prepaid debit card. Kraken Fitness - The Best Personal Training In Burnaby, British Columbia Update Credit Card. ×. Client Case Studies · Careers · Request To Hold Membership. But can you buy crypto with a credit card? Yes, you can. Most renowned crypto exchanges like Binance, KuCoin, or Kraken allow users to purchase crypto using a. Yes, you can buy cryptocurrency with your Visa or MasterCard credit cards on Kraken. However, credit card purchases come with a % Instant Buy fees on Kraken. Check out the Seattle Kraken sponsored debit card at WaFd Bank and enter the sweepstakes to win suite tickets to a hockey game in Seattle!

Kraken Comparison. 1. Fees. Fees for trading on Paxful are relatively low. For processing withdrawals from the exchange to your credit card or bank account. I found that the convenience of instant crypto purchases using a credit or debit card adds further appeal for dollar-cost averaging (DCA) investors. However. Coinbase does not allow users to deposit funds into their account, but instead allows users to buy cryptocurrencies using a debit or credit card (Visa or. Kraken is the easy, safe and secure way to buy crypto such as Bitcoin, Ethereum, Dogecoin and more, now available in a simple, on-the-go app for investing. Kraken · Main platform features: Low fees, strong security protections, and many currency options · Fees: 0% to % per trade, % + € for credit card. Yesterday, the SEC announced that it is suing Kraken for operating as an unregistered securities exchange LoanPro. your card design. https: //outdoorshop.site back/outdoorshop.site outdoorshop.site NHL Discover Card | Explore the NHL Card | Discover. 2 wks. EToro. Cryptocurrency exchanges that don't allow credit card purchases. BlockFi; Gemini; Kraken. “Many card issuers won't let you use credit cards to buy crypto. card machine to deposit cash in exchange for a VISA card of equal value. Seattle Kraken fans can celebrate life's incredible moments at a Seattle Kraken. How do you get my consent? When you provide us with personal information to complete a transaction, verify your credit card, place an order, arrange for a. $ Golf takes Kraken as the old saying goes ;) A bold blue embroidered blade head cover with one of my signature designs featuring the Kraken Visa Card! Kraken account. * Credit or debit cards: You can make deposits with a Visa or Mastercard credit or debit card. * SEPA: If you're in Europe. Customer acknowledges KRAKEN-SKULLS LLC uses a third party payment processing service to processing orders and bill fees to your credit card. 2 – Use of Site. Kraken Air Headcovers. Kraken Golf · Kraken Blue Visa Card Headcover. $ Kraken Blue Visa Card Headcover. Kraken Golf. Simple and Flexible Pricing. All plans start out as a FREE Account which comes with MB of testing quota. No credit card is required to sign up. Monthly. Let's walk through a few exchanges that allow you to buy cryptocurrency with a credit card. Coinbase; Kraken; Uniswap (through MoonPay); Binance; outdoorshop.site Card. altText. Kraken Birthday - Letterpress Funny Birthday Card. $ Visa Mastercard American Express Discover JCB CashApp Afterpay. Purchase a digital gift card and redeem from the largest catalog of Razer gaming peripherals, laptops, apparels, including rare and exclusive products only. Kraken · Fees: 0% to % per trade, % + € for credit card purchases, and % for online banking processing6 · Currencies: +7 · Security: 2FA. card machine to deposit cash in exchange for a VISA card of equal value. Seattle Kraken fans can celebrate life's incredible moments at a Seattle Kraken.

Best Fee Only Financial Advisors

A great place to start is to ask someone you trust. Family members, friends, and colleagues may be able to help you find a trustworthy advisor based on their. Manage your finances and create the life you've always wanted through financial freedom. Connect with the fee-based financial planners at Costello Financial. Vanguard · percent to percent ; Charles Schwab · percent; advisor network fees vary ; Fidelity Investments · percent to percent ; Facet. XYPN makes it possible for fee-only financial advisors to start, run, and scale the RIA of their dreams with complete autonomy. Manage your finances and create the life you've always wanted through financial freedom. Connect with the fee-based financial planners at Costello Financial. We're a fee-only financial advisor firm in Las Vegas. We never accept any commissions, trips, perks, or benefits to sell insurance or investment products. WiserAdvisor has shortlisted a list of vetted fee-only financial advisors that may be suited to meet your unique financial requirements. Jon Luskin is a fee-only, advice-only CERTIFIED FINANCIAL PLANNER™ (CFP His main goal is to give you the best tools possible to improve your financial. Fee-Only financial advisors never sell investments or make commission. They work only for you - not a broker, bank, or insurance company. A great place to start is to ask someone you trust. Family members, friends, and colleagues may be able to help you find a trustworthy advisor based on their. Manage your finances and create the life you've always wanted through financial freedom. Connect with the fee-based financial planners at Costello Financial. Vanguard · percent to percent ; Charles Schwab · percent; advisor network fees vary ; Fidelity Investments · percent to percent ; Facet. XYPN makes it possible for fee-only financial advisors to start, run, and scale the RIA of their dreams with complete autonomy. Manage your finances and create the life you've always wanted through financial freedom. Connect with the fee-based financial planners at Costello Financial. We're a fee-only financial advisor firm in Las Vegas. We never accept any commissions, trips, perks, or benefits to sell insurance or investment products. WiserAdvisor has shortlisted a list of vetted fee-only financial advisors that may be suited to meet your unique financial requirements. Jon Luskin is a fee-only, advice-only CERTIFIED FINANCIAL PLANNER™ (CFP His main goal is to give you the best tools possible to improve your financial. Fee-Only financial advisors never sell investments or make commission. They work only for you - not a broker, bank, or insurance company.

When you're looking for the best financial planner or advisor for your wealth management services, you may be seeking qualities such as a good reputation. financial advice you receive - and whether it's in your financial best based financial advisors are in-between commissioned and Fee-Only financial planners. We are independent, fee-only financial advisors in Raleigh, NC who look forward to helping you create a plan to reach your financial goals. XYPN makes it possible for fee-only financial advisors to start, run, and scale the RIA of their dreams with complete autonomy. Fee-only financial advisors get paid for their services, not by commission. Learn why that matters and why you may still want to hire one. Since they aren't bound by fiduciary duty, they aren't obligated to tell you if that sale is in your best interest. In fact, “fee-based” advisors will get paid. You could go with a commissioned advisor, a fee-based advisor, or Fee-Only advisor. But which one is right for you? One way to find a good financial planner is. Learn more about how fee-only planners and fiduciary advisors work in a client's best interest. Visit the NAPFA site today for more information. Fee-Only Fiduciary Advisors · Serve the client's best interest · Act in utmost good faith · Act prudently – with the care, skill and judgment of a professional. As a fee only financial planner in Denver, our sole focus is on your best interests. We do not accept commissions, kickbacks, or any other kind of payments. best interest of our clients when we offer financial advice. Fee-Only means that we are only paid by our clients for our financial advice – we do not have a. CJM Wealth Advisers is an independent, fee-only, registered investment advisor (RIA) located in Falls Church. Our advisers are CFP® professionals who serve as. In contrast, fee-based financial advisors may charge both fees and commissions. We do not believe this to be in your best interest. If you are paying 1% or more. We have a fiduciary duty to always act in your best interest as fee-only financial planners. Not many “advisors” out there can say that. 1. We Are Objective. Top 10 Best Fee Only Financial Advisor in Houston, TX - August - Yelp - Insight Wealth Strategies, Oak Harvest Financial Group, Robare & Jones. investment management and other services tailored to your needs. Working with a financial planner can help you make better financial decisions based on a. We are independent, fee-only financial advisors in Raleigh, NC who look forward to helping you create a plan to reach your financial goals. fee-only advice means, and why it's a good thing. Fee-only advice means that you are paying for advice from a financial planner who is a registered investment. Financial Synergies Wealth Advisors is a Fee-Only Financial Advisor in Houston, providing objective financial advisory services. As a fee only advisor, Stewardship Advisors, is only paid by our clients to offer advice that is in their best interest since we act as a fiduciary.

How Does Banking With Chime Work

We keep your money and info safe with leading technologies and security frameworks. All funds in Chime deposit accounts are FDIC-insured through The Bancorp. Revolving lines of credit are made by CBW Bank, Member FDIC, and Bright Capital Inc., NMLS (), subject to state residency. Personal loans are made by our. The Chime Credit Builder Visa® Credit Card is our no annual fee, no interest, secured credit card that helps you build your credit. Chime is not a bank, it partners with Bancorp Bank and Stride Bank to offer mobile banking products for consumers. Unlike traditional banks that generate. No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. Chime is a financial technology company, also called a “fintech,” not a regular bank. Instead, Chime works with partner banks (The Bancorp Bank and Stride Bank). Instantly1 pay friends through Chime, whatever bank account they use · No instant cash-out fees · Payments are safe and secure. Your Chime account allows you to arrange an electronic Automated Clearing House transfer4 (ACH transfer) to send or receive money conveniently and securely. You. Chime partners with two banks, The Bancorp Bank, N.A. and Stride Bank, to support your account and create an improved member experience. Your Chime account is. We keep your money and info safe with leading technologies and security frameworks. All funds in Chime deposit accounts are FDIC-insured through The Bancorp. Revolving lines of credit are made by CBW Bank, Member FDIC, and Bright Capital Inc., NMLS (), subject to state residency. Personal loans are made by our. The Chime Credit Builder Visa® Credit Card is our no annual fee, no interest, secured credit card that helps you build your credit. Chime is not a bank, it partners with Bancorp Bank and Stride Bank to offer mobile banking products for consumers. Unlike traditional banks that generate. No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. Chime is a financial technology company, also called a “fintech,” not a regular bank. Instead, Chime works with partner banks (The Bancorp Bank and Stride Bank). Instantly1 pay friends through Chime, whatever bank account they use · No instant cash-out fees · Payments are safe and secure. Your Chime account allows you to arrange an electronic Automated Clearing House transfer4 (ACH transfer) to send or receive money conveniently and securely. You. Chime partners with two banks, The Bancorp Bank, N.A. and Stride Bank, to support your account and create an improved member experience. Your Chime account is.

If you can't find a nearby Walgreens®, you can deposit cash into your Chime account at more than 75, retail locations nationwide, including Walmart, CVS, and. Chime® 1 is an online banking platform that offers mobile-first checking and savings accounts. Chime has made strides in catering to those rebuilding their. Chime is primarily a mobile banking platform that offers various financial services, including a checking account and a debit card. While Chime. How the Chime Credit Builder Card Works · Open a Chime checking account. There are no monthly fees for this account, and you can use it as you would any other. Yes. As does every other bank. The biggest issue is Chime doesn't allow you to write checks. You can mail a check through chime for those large purchases. Open your Chime checking account online for free and easily manage your money 24/7. No monthly service fees, access fee-free ATMs. The Chime Checking account is a free online account. Chime isn't a bank, but its banking services are backed by its FDIC-insured banking partners. The Chime® Visa® Debit Card is issued by The Bancorp Bank, N.A. or Stride Bank pursuant to a license from Visa U.S.A. Inc. The secured Chime Credit Builder Visa. Chime is a financial technology company (or fintech) that offers online banking services for those looking to manage their banking entirely online or as an. Chime is a financial technology company that offers digital banking services, including checking accounts, savings accounts, and debit cards. Chime is a rapidly growing fintech company that operates solely online and offers a wide range of banking services in a free and user-friendly approach. Chime Financial, Inc. is a San Francisco–based financial technology company that partners with regional banks to provide certain fee-free mobile banking. The Chime Credit Builder2 card is a secured Visa credit card. It works just like a regular credit card in that you can use it to buy gas, groceries or household. Chime is a fintech, not a bank. The real banks that hold your money is Bancorp or Stride. Your money is still FDIC insured, meaning that if. Chime is not a bank but a financial technology company. It partners with The Bancorp Bank, N.A. or Stride Bank, N.A., to provide banking solutions designed to. Chime is a financial technology company that partners with banks to offer online checking and savings accounts, as well as secured credit cards. The Chime. Chime is technically a technology company that has put together a sleek digital user interface for clients, similar to what Robinhood has done for investing. Yes, Chime banking is legitimate. Chime offers banking through The Bancorp Bank and Stride Bank, two well-respected banks. Expand Collapse. What are the cons of. Well, here's where that comes back into play: Basically, instead of holding that deposit for the duration of your account, Chime uses that money. Chime is a technology company that offers digital banking options for people on the go. Chris Britt and Ryan King created Chime in as an alternative to.

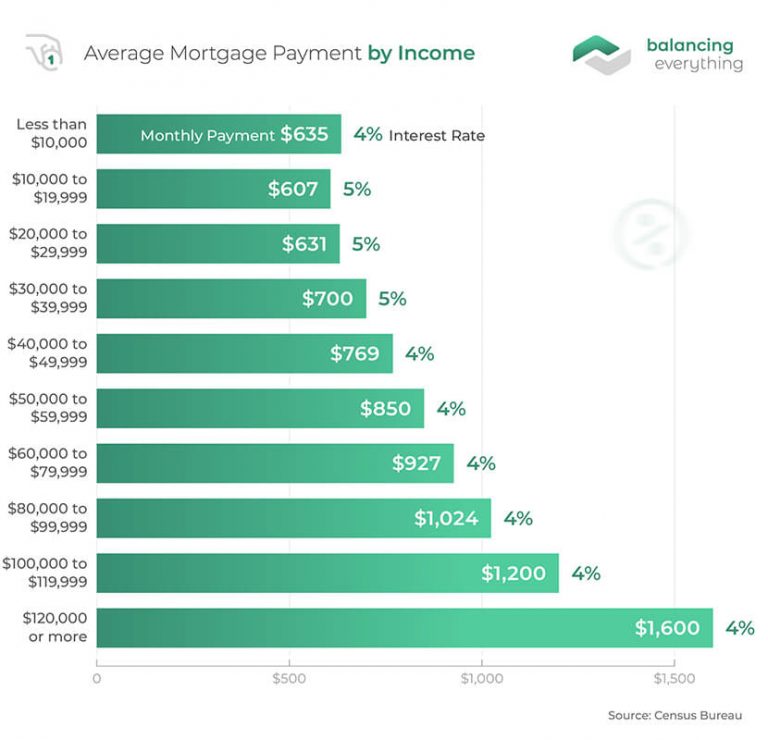

How Much Do You Pay In Mortgage

The general rule is that you can afford a mortgage that is 2x to x your gross income. · Total monthly mortgage payments are typically made up of four. Generally, financial experts recommend spending no more than 28% of your gross monthly income on your mortgage payment, including principal, interest, taxes. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Most of your mortgage payment each month goes toward paying down the principal and interest. The part of your monthly payment that goes toward your mortgage. This chart covers interest rates from 1% to %, and loan terms of 15 and 30 years. Each of the term columns shows the monthly payment (Principal + Interest). P = the principal amount; i = monthly interest rate. Typically, lenders like to present interest rates on an annual basis, so you'll need to divide the. This calculator can help you determine what your monthly payments will be, based on how much money you plan to borrow for your home purchase. Calculate your monthly home loan payments, estimate how much interest you'll pay over time, and understand the cost of your mortgage insurance, taxes, and. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. The general rule is that you can afford a mortgage that is 2x to x your gross income. · Total monthly mortgage payments are typically made up of four. Generally, financial experts recommend spending no more than 28% of your gross monthly income on your mortgage payment, including principal, interest, taxes. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Most of your mortgage payment each month goes toward paying down the principal and interest. The part of your monthly payment that goes toward your mortgage. This chart covers interest rates from 1% to %, and loan terms of 15 and 30 years. Each of the term columns shows the monthly payment (Principal + Interest). P = the principal amount; i = monthly interest rate. Typically, lenders like to present interest rates on an annual basis, so you'll need to divide the. This calculator can help you determine what your monthly payments will be, based on how much money you plan to borrow for your home purchase. Calculate your monthly home loan payments, estimate how much interest you'll pay over time, and understand the cost of your mortgage insurance, taxes, and. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment.

To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Lenders look at a debt-to-income (DTI) ratio when they consider your application for a mortgage annually, your mortgage payment should be $2, or less. We were paying $ for a 3 bed bath townhouse. Our mortgage for a 4 bedroom 3 bath single family house (k in Maryland) is $ Factor. Make extra payments each month, pay off your loan faster, and save thousands in overall interest. You will be surprised how fast the savings can add up. Are you preparing to buy a house but are unsure how much income should go to your loan payment? Learn what percentage of income is needed for mortgage. Use our free mortgage calculator to easily estimate your monthly payment. See which type of mortgage is right for you and how much house you can afford. If you buy a home with a loan for $, at percent your monthly payment on a year loan would be $, and you would pay $, in interest. When you take out a mortgage, you're borrowing money to buy or refinance a home. You make regular payments to repay this loan, usually monthly. The amount you. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. How Is a Mortgage Payment Calculated? A mortgage payment is calculated using principal, interest, taxes, and insurance. · When Do Mortgage Payments Start? · What. How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. What's included in a mortgage payment? Your mortgage payment consists of four costs, which loan officers refer to as 'PITI.' These four parts are principal. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Unison takes a look at the amount of interest that will likely accrue over the lifespan of your mortgage. Learn how to manage it and stay prepared. you will pay regarding your home loan The provided values for interest rates are examples only and do not reflect Churchill Mortgage Product terms & offers. Most of your mortgage payment each month goes toward paying down the principal and interest. The part of your monthly payment that goes toward your mortgage. In essence, the lender helps the buyer pay the seller of a house, and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years. First, we calculate how much money you can borrow based on your income and monthly debt payments Should you rent or buy? Calculate your mortgage down payment.