outdoorshop.site

Tools

How Much Does Drilling A New Well Cost

1. How much will a new well cost? · 2. What if I am on a budget? · 3. How long does it take to complete a well system? · 4. Can you drill any time of year? · 5. How. The cost of a domestic single family well ranges from $4, to $30, It will depend on the exact depth and how complex the well needs to be to provide you. Drilling a residential water well costs $25 to $65 per foot or $3, to $15, on average for a complete system and installation. Prices. Only the first feet of Well 5 is cased. On a $/foot basis, these five wells range from $97 to more than $ to drill and finish, with an average cost of. How Much Water Do I Need? You will need a dependable water supply for your What Steps Should Be Taken To Ensure. An Adequate Yield From My New Well? While the cost to drill and hook up a new well varies greatly, we've seen that the average cost of a new well and pump system is generally between $7, On average, a complete water well and pump system is $10, to $15, depending on location and site needs. Variables are: depth to bedrock, depth to water. What lies under the ground can figure into the cost as well. A well drilled in solid rock might not require the casing, but it can also affect the depth of the. Expect to pay between $ and $ to have your well extended. Cost Factors To Dig A Well. As you can see, the type of well you want to be dug will determine. 1. How much will a new well cost? · 2. What if I am on a budget? · 3. How long does it take to complete a well system? · 4. Can you drill any time of year? · 5. How. The cost of a domestic single family well ranges from $4, to $30, It will depend on the exact depth and how complex the well needs to be to provide you. Drilling a residential water well costs $25 to $65 per foot or $3, to $15, on average for a complete system and installation. Prices. Only the first feet of Well 5 is cased. On a $/foot basis, these five wells range from $97 to more than $ to drill and finish, with an average cost of. How Much Water Do I Need? You will need a dependable water supply for your What Steps Should Be Taken To Ensure. An Adequate Yield From My New Well? While the cost to drill and hook up a new well varies greatly, we've seen that the average cost of a new well and pump system is generally between $7, On average, a complete water well and pump system is $10, to $15, depending on location and site needs. Variables are: depth to bedrock, depth to water. What lies under the ground can figure into the cost as well. A well drilled in solid rock might not require the casing, but it can also affect the depth of the. Expect to pay between $ and $ to have your well extended. Cost Factors To Dig A Well. As you can see, the type of well you want to be dug will determine.

Here in the state of North Carolina, the average well installation cost falls somewhere between $ and $ Give us a call today to learn more. How Much Does Well Drilling Cost? ; $15 ; -$30 per foot, or ; $1, ; -$3, for a ' deep well, and ; $6, The biggest question in drilling a well is "how much is a new well going to cost? We'll do our best to check neighborhood water wells for well depths. The average boring/drilling cost for a water well is anywhere between $ per foot of depth (or $ per foot for a complete installation). Below are the. The cost of a drilling a new well can run from $2, for just the drilling to $20, for a comprehensive, deep well system. Prior to drilling a new well, or deepening or modifying an existing well, a Shared Wells - ADWR does not regulate shared well agreements, as a. The estimated average cost is approximately $23 per well (Bock et al., ; Bank and Kuuskraa, ). Well drilling costs. Well. FAQs for Drilling: Q: HOW IS A WELL DRILLED? Q: HOW MUCH DOES A WELL COST? Q: HOW DEEP SHOULD MY WELL BE? Q: WHERE SHOULD MY WELL BE DRILLE. Although it is impossible to tell exactly how much a well will cost beforehand, our average well in was about $ Where do you know where to drill? Well drilling costs $25 to $65 per foot to put in complete system installation. The average cost to dig or drill a new water well is $ to $ Well Drilling Cost the average csot to drill a well is $5, or $1, to $12, Drilling a well costs $5, for an average depth of feet. Most. Shallow well pumps will average around $$ to install while deep well pump are a little higher. You should plan on choosing a new pump that completely. costs for a new well contract. Q: What do I need to do before you drill and what will I need to do after your done Drilling? A: Every installation is. The average well pump cost is between $ and $5, for a domestic water well, not including the cost of installation. The most important factor in. On average you should budget $8, - $10, for drilling a well. Our water well drilling agreement will list every cost item in full detail. How much does it. This brings the typical total for drilling a well and setting up a private water delivery system to $3,$20, or more, but an especially deep and difficult. Water well drilling cost is determined by the total depth drilled and the total depth of the completed well. Additional costs which are included on the contract. In , the Legislature passed a new law that updates the fee structure for water wells, and adds a fee for decommissioning wells. What Is The Average Cost To Drill A Well? To have a professional company do it for you will generally cost in the range of $15/ft- $30/ft. Note that the cost. Water well prices for panhandle are from 35 to 80 per ft. Depending on how deep, and what size hole. average cost of drilling a water well in texas. Austin.

How To Send Apple Pay To Bank

Enter an amount on the keypad and tap Send. In Wallet, choose your Apple Cash card and tap Send or Request. You can select from a list of suggested recipients. Simply open the Apple Wallet app, tap + to add your card. When prompted, enter the card details or capture an image of your Bank of Ireland debit or personal. On your iPhone, open the Wallet app and tap Apple Card. · Tap Savings account. · Tap Withdraw. · Enter the amount that you want to withdraw, then tap Next. · Select. You can add money to your stc pay account and card with different options: Apple pay, Iban transfer, Sadad or by adding your bank card. From your invoice notification, select Pay Invoice. · Select Pay by bank transfer (ACH). · Select Instant verification to verify your account. · Continue through. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. You used Apple Pay (the money transfer method like Zelle or Venmo) to move money from your Apple Cash account (a debit card backed by Green Dot. This means that person may be able to make payments with your Apple Cash Card and send your money through the Funds Transfer Service to another User or a bank. The only exception would be if your bank usually charges you to use Apple Pay. If this is the case, the charge will vary dependent upon the bank, and is not. Enter an amount on the keypad and tap Send. In Wallet, choose your Apple Cash card and tap Send or Request. You can select from a list of suggested recipients. Simply open the Apple Wallet app, tap + to add your card. When prompted, enter the card details or capture an image of your Bank of Ireland debit or personal. On your iPhone, open the Wallet app and tap Apple Card. · Tap Savings account. · Tap Withdraw. · Enter the amount that you want to withdraw, then tap Next. · Select. You can add money to your stc pay account and card with different options: Apple pay, Iban transfer, Sadad or by adding your bank card. From your invoice notification, select Pay Invoice. · Select Pay by bank transfer (ACH). · Select Instant verification to verify your account. · Continue through. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. You used Apple Pay (the money transfer method like Zelle or Venmo) to move money from your Apple Cash account (a debit card backed by Green Dot. This means that person may be able to make payments with your Apple Cash Card and send your money through the Funds Transfer Service to another User or a bank. The only exception would be if your bank usually charges you to use Apple Pay. If this is the case, the charge will vary dependent upon the bank, and is not.

On iPhone®, open the Wallet app and tap the plus sign. From there, follow the onscreen instructions. On Apple WatchTM, open the Apple Watch app on your iPhone. Submit. PeoplesBank. Personal; Personal · Bank · Checking · Savings · Online & Mobile Look for the Apple Pay icon at checkout to use Apple Pay. Look for this. When I click “transfer money to bank” the bottom sheet confirmation pops up and vanishes within a few milliseconds so I cannot confirm my transfer out. On the Apple Watch, double-click the side button and hold the display of your Apple Watch up to the payment terminal. Or pay within apps on iPhone or iPad. To transfer money from Apple Cash to a bank account, it must first be connected to the app. Go to Settings > Wallet & Apple Pay > Apple Cash, then select Bank. Select "Apple Pay Settings" and follow the on-screen instructions. Next. We couldn't send the link · Log in to the app · Tap the Menu option in the navigation bar · Tap Manage Debit/Credit Card · On your desired card, tap Digital Wallets. You can send money to your receiver's debit or credit1 card by choosing to pay with either a bank card, Sofort, or bank transfer. You can also use Apple Pay® on. Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are send money directly to their bank account. There are no fees to send or. Open the Apple Wallet app. · Select your Apple Cash card. · Press the More Options symbol in the top right corner. · Select Transfer to Bank. · Enter the balance. Log into the Apple Bank app1. In the main menu, select "Send money with Zelle®." Enroll your email address or U.S. mobile number. You're ready to start. It cannot transfer funds. Banks transfer funds domestically through the Automatic Clearing House (ACH) system sponsored by the Federal Reserve Bank. Apple does. From there, hold the top of your iPhone near the contactless reader until it displays the word “Done” and a checkmark. Pay With Your iPad. This process is. 1. Transfer Money To Your Bank Account · Ensure your iPhone or iPad has the latest version of iOS or iPadOS, and you added an eligible debit card to the Wallet. Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are send money directly to their bank account. There are no fees to send or. Open the Wallet app (formerly Passbook) · Tap the plus sign to add your TD Bank Visa cards · Hold your compatible Apple device near a contactless reader at a. This means that person may be able to make payments with your Apple Cash Card and send your money through the Funds Transfer Service to another User or a bank. Load your Bank of the Sierra debit card into your mobile wallet app, then speed through checkout. It's easy to add your debit card to Apple Pay, Google Pay, or. To pay online or via an app, simply look for the Apple Pay or Google Pay* button. *The purchase limit per transaction is $ for debit cards and credit cards.

Capital Gains Tax In Real Estate

Under FIRPTA, foreign nationals selling U.S. real estate are subject to tax on any capital gain. The IRS requires a 15% withholding of the sale price as a. Capital gains can apply to almost any investment that is sold at a profit, such as stocks, bonds, real estate, precious metals, options contracts, or even. The capital gain will generally be taxed at 0%, 15%, or 20%, plus the % surtax for people with higher incomes. However, a special rule applies to gain on the. Capital gains tax is payable on the net gain from the sale of property. The gain is calculated by taking the sale price less the purchase price and all. Georgia Capital Gains Tax For Short Term And Long Term Capital Gains · $0 to $ (individuals) and $0 to $1, (joint filers) are taxed at 1%. · $ to. How does the federal government tax capital gains income? Four maximum federal income tax rates apply to most types of net long-term capital gains income in tax. Your tax rate is 20% on long-term capital gains if you're a single filer earning more than $,, married filing jointly earning more than $,, or head. Do I owe capital gains tax when I sell real estate? No. Washington's capital gains tax does not apply to the sale or exchange of real estate. It does not. Capital Gains Tax Rates for 20; Single, Up to $44,, $44, to $,, Over $, ; Head of household, Up to $59,, $59, to $, Under FIRPTA, foreign nationals selling U.S. real estate are subject to tax on any capital gain. The IRS requires a 15% withholding of the sale price as a. Capital gains can apply to almost any investment that is sold at a profit, such as stocks, bonds, real estate, precious metals, options contracts, or even. The capital gain will generally be taxed at 0%, 15%, or 20%, plus the % surtax for people with higher incomes. However, a special rule applies to gain on the. Capital gains tax is payable on the net gain from the sale of property. The gain is calculated by taking the sale price less the purchase price and all. Georgia Capital Gains Tax For Short Term And Long Term Capital Gains · $0 to $ (individuals) and $0 to $1, (joint filers) are taxed at 1%. · $ to. How does the federal government tax capital gains income? Four maximum federal income tax rates apply to most types of net long-term capital gains income in tax. Your tax rate is 20% on long-term capital gains if you're a single filer earning more than $,, married filing jointly earning more than $,, or head. Do I owe capital gains tax when I sell real estate? No. Washington's capital gains tax does not apply to the sale or exchange of real estate. It does not. Capital Gains Tax Rates for 20; Single, Up to $44,, $44, to $,, Over $, ; Head of household, Up to $59,, $59, to $,

Capital Gains Tax on Inherited Properties Capital gains tax is due on the sale of all real estate unless the homeowners qualify for a tax exclusion or. However, the New Caledonian government has recently implemented a taxation on capital gain deriving from real properties. The tax on private real estate capital. State Capital Gains Tax Rates ; 29, Missouri *, % ; 30, Oklahoma, % ; 31, Mississippi, % ; 32, Utah, %. Having an investment property complicates the calculation of the capital gains amount due to rental income real estate taxation rules. You may also have to. Capital gain calculation in four steps · Determine your basis. · Determine your realized amount. · Subtract your basis (what you paid) from the realized amount . You'll pay 0% in capital gains if You're a single filer earning less than $39,, married filing jointly earning less than $78,, or head of household. Capital gains can apply to almost any investment that is sold at a profit, such as stocks, bonds, real estate, precious metals, options contracts, or even. Deferring Capital Gains Tax: Buying another home after selling an investment property within days can defer capital gains taxes. Although reinvesting the. After all, up to $, of the profit earned when selling real estate with a spouse is tax-free, or $, if a single person sells. Nevertheless, $, When you sell a stock, you owe taxes on your gainthe difference between what you paid for the stock and what you sold it for. The same is true with selling. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. Could you owe capital gains tax on your home? There's an exclusion on gains from the sale of a primary residence, which generally lets sellers exclude up to. Using the capital gain calculator will help you determine the total tax you need to pay on any profit you've earned through the sale of an asset. Real Estate Capital Gains Calculator · Net adjusted basis · Capital gain · Depreciation recapture (25%) · Federal capital gains tax · State capital gains tax · Total. A special real estate exemption for capital gains Since , up to $, in capital gains ($, for a married couple) on the sale of a home is exempt. Then, you'll apply the appropriate tax rate based on the type of capital gain it is and the various tax rates. Long-term capital gains tax rates are 0%, 15%. The capital gains tax is a tax on the profit you make when you sell an investment, such as stock or real estate. Learn more. When you sell a stock, you owe taxes on your gainthe difference between what you paid for the stock and what you sold it for. The same is true with selling. Keep in mind that if you earn over $, as a married couple or $, as an individual, including your real estate sale gains, you are subject to an. Capital gains tax is payable on the net gain from the sale of property. The gain is calculated by taking the sale price less the purchase price and all.

Lexington Law For Credit

The credit repair lawyers and experts at Lexington Law work to help you repair your bad credit report and scores. Call today for a free credit repair. The nation's leading credit repair firm, helping consumers since · Affordable credit repair services · Over 7,, negative items removed in · Call us. The Lexington Law app lets you follow your credit repair progress. With access to a variety of tools, you can better understand, improve and protect your credit. Lexington Law is a law firm with services to fix credit reporting issues, identify negative items hurting score, and improve credit profile. The nation's leading credit repair firm, helping consumers since · Affordable credit repair services · Over 7,, negative items removed in · Call us. Both of our law firms fix credit reports for people. Simply stated, we provide our services for free to you. While our firm is a just a bit older, we still fix. Lexington Law: Credit Repair Services. We're here to help! For additional support on this topic or for more information on how to get started reach out to our. The Premier Plus option at Lexington Law comes with world-class credit reporting options for $ per month. These include tracking and analyzing FICO scores. Overall, Lexington Law is a trusted firm and is known for its top-rated, reputable credit repair services and professional staff. The credit repair lawyers and experts at Lexington Law work to help you repair your bad credit report and scores. Call today for a free credit repair. The nation's leading credit repair firm, helping consumers since · Affordable credit repair services · Over 7,, negative items removed in · Call us. The Lexington Law app lets you follow your credit repair progress. With access to a variety of tools, you can better understand, improve and protect your credit. Lexington Law is a law firm with services to fix credit reporting issues, identify negative items hurting score, and improve credit profile. The nation's leading credit repair firm, helping consumers since · Affordable credit repair services · Over 7,, negative items removed in · Call us. Both of our law firms fix credit reports for people. Simply stated, we provide our services for free to you. While our firm is a just a bit older, we still fix. Lexington Law: Credit Repair Services. We're here to help! For additional support on this topic or for more information on how to get started reach out to our. The Premier Plus option at Lexington Law comes with world-class credit reporting options for $ per month. These include tracking and analyzing FICO scores. Overall, Lexington Law is a trusted firm and is known for its top-rated, reputable credit repair services and professional staff.

With 19 years of experience in the credit repair industry, Lexington Law boasts an unparalleled understanding of credit laws and practices. Lexington Law Credit Repair Services has a law office located in North Salt Lake, UT. Martindale-Hubbell provides the office's address, phone number. Lexington Law is a reliable and experienced credit restoration with a lengthy history of delivering results. It depends on what negative marks are on your credit report. And if they are valid. If it is a bill collector, dispute them as no contract with the company. Lexington Law is a good choice if you're looking for several services and features to help you improve your credit. However, it does have several complaints. What's your credit costing you? Remove inaccurate or unfair items on your credit report at outdoorshop.site Since , Lexington Law clients have seen over John Heath on the Balancing Act. views ; Wage Garnishment: How to Deal With It [The Right Way]. views ; Facts About Buying a Car and Your Credit Score. Understanding Credit | Lexington Law · Trying to understand credit can be confusing. Watch these videos to learn about good credit, credit repair, and your. I used Lexington Law for 3 months and they did nothing for my credit. They sent letters to the three credit bureaus but that was it. They did nothing I couldn't. McCarthy Law has partnered with Lexington Law to offer our litigation services to individuals who have been harmed by inaccurate credit reporting. Our FCRA. Lexington Law provides consumers with a destination for all services needed to navigate and improve their position in the credit ecosystem and manage their. Lexington Law is a credit repair firm that helps amend inaccurate or questionable items affecting your credit score. LEXINGTON LAW CREDIT REPAIR SERVICES, 36 W 44th St, Ste , New York, NY , 8 Photos, Mon - am - pm, Tue - am - pm, Wed - am. The credit repair lawyers and experts at Lexington Law work to help you repair your bad credit report and scores. Call today for a free credit repair. LEXINGTON LAW CREDIT REPAIR SERVICES, 36 W 44th St, Ste , New York, NY , 8 Photos, Mon - am - pm, Tue - am - pm, Wed - am. Credit repair companies such as Lexington Law can accelerate your rehabilitation by removing unverified, inaccurate, and unfair items from your credit reports. Laws are created to protect us. Lexington Law believes in your legal right to a fair, accurate and substantiated credit report. #LetLexingtonHelp. outdoorshop.site and Lexington Law are both top-ranked companies that offer high-quality credit repair services. Lexington Law firm are leaders in credit repair for a reason. Our lawyers are your advocates, and will leverage every legal standard for your credit. Enroll. The Premier Plus option at Lexington Law comes with world-class credit reporting options for $ per month. These include tracking and analyzing FICO scores.

How Much Can I Pawn A 10k Gold Ring For

Based on the current price of 10K gold, a troy ounce of 10k gold would be worth $1, At Express Gold Cash, we pay up to 90% of that value for gold bullion. Jewelry · wedding ring. wedding ring. Find a Value Pawn Location Near You. Find a Location. Value Pawn And Jewelry. Pawn. How pawn works · What can i pawn? Shop. How much can you get for 10k gold? This varies significantly on many factors, the worldwide gold market, the pawnbroker and the condition/amount of gold you. Gent's Gold-Diamond Wedding Band 25 Diamonds Carat T.W. 14K Yellow Gold · $ ; Gent's Diamond Fashion Ring 88 Diamonds Carat T.W. 10K Yellow Gold. Passing the 10K requirement for “gold” jewelry and having enough other metals in it to make it reliable, 14k jewelry is one of the top choices for wedding rings. G 10K Yellow Gold Cushion Cut Citrine With 21 Diamond Accents · 10k Yellow Gold ring With Topaz and Diamond Accents · g 10K White Gold Diamond Circle. This handy calculator will let you know how much typical pawn shops will give you for your diamond and gold rings, your wedding bands, bracelets, earrings. How Much Is My Gold Diamond Ring Worth? · How Much Is a 10k Gold Ring Worth? · Why Should I Sell My Gold Ring To Cash For Gold USA? Gold plated is worth nothing, 10kt gold plated is worth less than nothing. Congrats on the ward though..? Based on the current price of 10K gold, a troy ounce of 10k gold would be worth $1, At Express Gold Cash, we pay up to 90% of that value for gold bullion. Jewelry · wedding ring. wedding ring. Find a Value Pawn Location Near You. Find a Location. Value Pawn And Jewelry. Pawn. How pawn works · What can i pawn? Shop. How much can you get for 10k gold? This varies significantly on many factors, the worldwide gold market, the pawnbroker and the condition/amount of gold you. Gent's Gold-Diamond Wedding Band 25 Diamonds Carat T.W. 14K Yellow Gold · $ ; Gent's Diamond Fashion Ring 88 Diamonds Carat T.W. 10K Yellow Gold. Passing the 10K requirement for “gold” jewelry and having enough other metals in it to make it reliable, 14k jewelry is one of the top choices for wedding rings. G 10K Yellow Gold Cushion Cut Citrine With 21 Diamond Accents · 10k Yellow Gold ring With Topaz and Diamond Accents · g 10K White Gold Diamond Circle. This handy calculator will let you know how much typical pawn shops will give you for your diamond and gold rings, your wedding bands, bracelets, earrings. How Much Is My Gold Diamond Ring Worth? · How Much Is a 10k Gold Ring Worth? · Why Should I Sell My Gold Ring To Cash For Gold USA? Gold plated is worth nothing, 10kt gold plated is worth less than nothing. Congrats on the ward though..?

Most of the time, any loan that you'll receive from a pawn shop will be for significantly less than the item you're pawning is worth. For example, if you pawn a. Pawning jewelry is one of the fastest ways to make a quick buck when you're in a pinch. It can be sad to let go of your old valuables, but sometimes paying. 10K Gold Diamond Engagement and Wedding Band g Size · $ ; 10K 2-TONE ROUND CUT DIAMOND SOLITAIRE RING, SIZE: 7, GRAMS · $ ; 10K Black Hills. When you have gold jewelry you are considering selling for cash or payment by check, it can be extremely difficult to determine just how much cash you will be. Keep in mind that the market fluctuates, but you can get a rough estimate by checking online resources like gold price charts. Upvote 1. Luckily, this doesn't mean that you can't sell 10k, 14k, 18k or 22k gold. If Like pawn shops, jewelry stores will generally offer low prices for your gold. Pawning jewelry is one of the fastest ways to make a quick buck when you're in a pinch. It can be sad to let go of your old valuables, but sometimes paying. I have a ring with TOB 10k and would like to know as well. Reply. Jeannette Gold ring 14k SLO how much real gold is in something like this? SLO part. How Much Is My Gold Diamond Ring Worth? · How Much Is a 10k Gold Ring Worth? · Why Should I Sell My Gold Ring To Cash For Gold USA? Let's find out how much a10k gold ring is worth! ; 24K gold market price per gram, $ ; 10K gold selling value per gram, $ ; 10K gold selling value per. A great way to get some extra cash is to sell your gold online or through the mail. At GoldFellow, we give you the means to do both! · We have seen class rings. So, for example, a $10, retail price diamond ring sold in a new jewelry store has about a $3, resale price, and if you pawn it, you'll likely only get. 10K Yellow Gold Horseshoe Ring with Diamond. $ Men's 14K White Gold View on map. Contact Info. Phone: PAWN () Text ONLY: They will explain how much gold is in each piece and how much you are being Our gold prices for 10k, 14k and 18k are always posted in our jewellery. We've explained how each of these factors affects how much a pawn shop will be willing to pay for your gold jewelry below. Deal Alert: Get 25% off engagement. Gold and platinum jewelry will typically get you a larger loan because they are worth more than items made of silver. As of February , gold is trading for. So, if your necklace contains about $ worth of gold, a fair offer would be $ to $ Another way to calculate it is to reduce the per-gram value by 10k Gold Ring. $Price. Quantity. Add to Cart. 10 karat yellow gold ring. Ring is size Stop by Salerno Pawn and Jewelry to see our gold rings. # 10k Gold Ring. $Price. Quantity. Add to Cart. 10 karat yellow gold ring. Ring is size Stop by Salerno Pawn and Jewelry to see our gold rings. #

Li Vs Nio Stock

compare icon Compare NIO vs All Stocks ; ai score. NIO (NIO) vs LI (Li Auto). NIO Vs All Stocks: Compare stocks using Artificial Intelligence insights. Which stock is a better buy? Make smart data-driven investment decisions. The year-to-date returns for both investments are quite close, with NIO having a % return and LI slightly higher at %. The chart below displays the. The year-to-date returns for both stocks are quite close, with LI having a % return and NIO slightly lower at %. The chart below displays the growth. 65 Day Avg: M. % vs Avg. Day Range 52 Week EVs NIO, Li Auto, and XPeng Stocks Rise on Deliveries. One Result Was Better. SUMMARY. The Market Cap of Li Auto stood at about $20 billion, while the market cap of Nio and XPeng stood at about $8 billion and $ billion respectively. Analysts expect adjusted earnings to reach $ per share for the current fiscal year. Nio Inc - ADR does not currently pay a dividend. Currently, Li Auto. 65 Day Avg: M. 62% vs Avg. Day Range 52 Week What's Going On With Chinese EV Stocks Like Nio, XPeng, Li Auto On Wednesday? NIO made its New York Stock Exchange (NYSE) debut on 12 September , with an initial quote of $ per share, giving the company a valuation of. compare icon Compare NIO vs All Stocks ; ai score. NIO (NIO) vs LI (Li Auto). NIO Vs All Stocks: Compare stocks using Artificial Intelligence insights. Which stock is a better buy? Make smart data-driven investment decisions. The year-to-date returns for both investments are quite close, with NIO having a % return and LI slightly higher at %. The chart below displays the. The year-to-date returns for both stocks are quite close, with LI having a % return and NIO slightly lower at %. The chart below displays the growth. 65 Day Avg: M. % vs Avg. Day Range 52 Week EVs NIO, Li Auto, and XPeng Stocks Rise on Deliveries. One Result Was Better. SUMMARY. The Market Cap of Li Auto stood at about $20 billion, while the market cap of Nio and XPeng stood at about $8 billion and $ billion respectively. Analysts expect adjusted earnings to reach $ per share for the current fiscal year. Nio Inc - ADR does not currently pay a dividend. Currently, Li Auto. 65 Day Avg: M. 62% vs Avg. Day Range 52 Week What's Going On With Chinese EV Stocks Like Nio, XPeng, Li Auto On Wednesday? NIO made its New York Stock Exchange (NYSE) debut on 12 September , with an initial quote of $ per share, giving the company a valuation of.

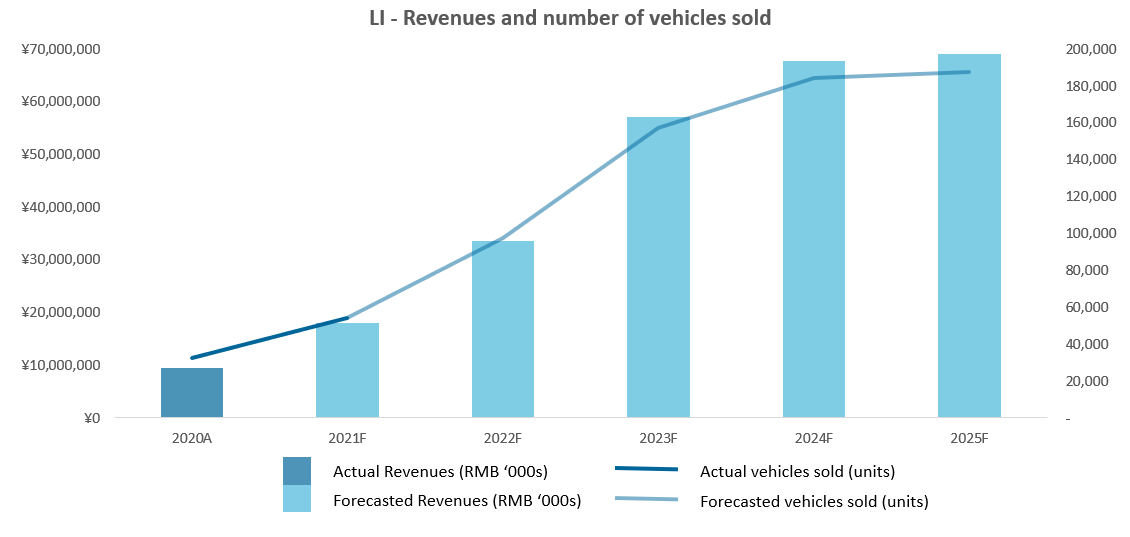

Measures how much net income or profit is generated as a percentage of revenue. , %. Earnings per share. Li Auto logo. Li Auto. 20LI. $ B. $ %. %, China. favorite NIO logo. NIO. 37NIO. $ B. $ %. %, China. favorite. In , Nio filed for a initial public offering on the New York Stock Exchange. Nio CEO William Li expects to sell Onvo cars in export markets. Nio vs Tesla Stock: From a valuation perspective, Nio has upside to Li currently serves as the CEO of NIO. NIO is often referred to as the Tesla. There has been a divergence in the price action of NIO, Li Auto, and Xpeng Motors over the last month. Which of these Chinese EV stocks do analysts like the. NIO (NYSE:NIO), Li Auto (NASDAQ:LI). Financials. Income Statement Represents the company's profit divided by the outstanding shares of its common stock. NIO made its New York Stock Exchange (NYSE) debut on 12 September , with an initial quote of $ per share, giving the company a valuation of. Will this crash continue further or will it be back to its original value soon? All related (31). There has been a divergence in the price action of NIO, Li Auto, and Xpeng Motors over the last month. Which of these Chinese EV stocks do analysts like the. The year-to-date returns for both investments are quite close, with NIO having a % return and LI slightly higher at %. The chart below displays the. The year-to-date returns for both stocks are quite close, with LI having a % return and NIO slightly lower at %. The chart below displays the growth. Will this crash continue further or will it be back to its original value soon? All related (31). NIO, known for its luxurious electric vehicles and innovative technology, has captivated investors with its strong performance. Li Auto, on the other hand. I am very happy for Li auto stock holders and the recent gains of over 40% in 5 days after Li auto first annual net profit. But we believe that you should have control over the extent to which you share your data with us. or handle all possible traffic, weather, and road conditions. Nio Inc - ADR. $ NIO %. Rivian Automotive Inc. $ RIVN Li Auto (LI): The Best Chinese Stock to Buy According to Wall Street Analysts? Analysts expect adjusted earnings to reach $ per share for the current fiscal year. Nio Inc - ADR does not currently pay a dividend. Currently, Li Auto. Nio is culturally a very Chinese company, and will do very well in China. They understand that the social and cultural aspects of the business. Nio Onvo shares L60 interior image, 1st production cars expected to roll off line Do not sell or share my personal information. A Raptive Partner Site. Li Auto, known for its hybrid electric vehicles, has been praised for its innovative technology and sustainable approach to transportation. NIO, on the other.

Calculate Buyout On Lease

Compare the Residual Value and the Actual Value. If your car's market value exceeds the residual value, it indicates a good buyout opportunity. Conversely. Typically, the buyout amount for a leased vehicle will be available on your monthly statement, taking several factors into account including remaining payments. The buyout amount should be very close to residual + (depreciation from remaining lease payments) + sales tax (if your state collects sales tax. Your monthly statements will include a section titled “Buyout Amount” or “Payoff Amount.” This includes the residual value of your vehicle determined at the. Yes, you can purchase your leased vehicle at any time during the lease. Contact us for forms, instructions, and the payoff amount. We cannot accept payoffs from. Lease Purchase: Is it Worth It? · Determine the residual value of the vehicle. · Determine the actual value of the vehicle. · Compare the residual value and the. Probably the easiest way to get your buyout quote is to check your lease plan. Look for a “buyout amount” or “payoff amount” that will be listed on your monthly. Learning how to calculate a lease buyout means getting familiar with associated fees and taxes. Becoming the owner of your car means that certain ownership. End your lease & keep your car with a new monthly payment. Get an estimate for a lease buyout loan based on your credit score & lease payoff amount. Compare the Residual Value and the Actual Value. If your car's market value exceeds the residual value, it indicates a good buyout opportunity. Conversely. Typically, the buyout amount for a leased vehicle will be available on your monthly statement, taking several factors into account including remaining payments. The buyout amount should be very close to residual + (depreciation from remaining lease payments) + sales tax (if your state collects sales tax. Your monthly statements will include a section titled “Buyout Amount” or “Payoff Amount.” This includes the residual value of your vehicle determined at the. Yes, you can purchase your leased vehicle at any time during the lease. Contact us for forms, instructions, and the payoff amount. We cannot accept payoffs from. Lease Purchase: Is it Worth It? · Determine the residual value of the vehicle. · Determine the actual value of the vehicle. · Compare the residual value and the. Probably the easiest way to get your buyout quote is to check your lease plan. Look for a “buyout amount” or “payoff amount” that will be listed on your monthly. Learning how to calculate a lease buyout means getting familiar with associated fees and taxes. Becoming the owner of your car means that certain ownership. End your lease & keep your car with a new monthly payment. Get an estimate for a lease buyout loan based on your credit score & lease payoff amount.

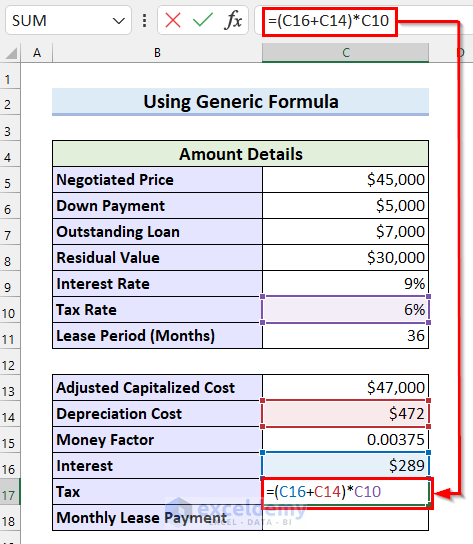

Use this calculator to find out your estimated monthly loan payment.

Steps on How to Calculate Car Lease Buyouts · Determine the residual value of the vehicle. · Determine the actual value of the vehicle. · Compare the residual. Check out your monthly leasing statement. You should see either a “buy off amount” or “payoff amount” listed somewhere inside. This amount should include the. How to Calculate a Lease Buyout Amount · Look up Your Vehicle's Residual Value · Find Your Vehicle's Actual Value · Determine The Higher Value · Remember Your. How to Calculate a Car Lease Buyout – 4 Steps · Find your car's residual value. · Figure out your vehicle's actual value. Of all the steps in our “how to. This buyout amount includes the residual value of your vehicle at the start of the lease, the total remaining payments, and possibly a car purchase fee . With a U.S. Bank auto lease, for example, your purchase-option price is calculated as the residual value (the projected value of the vehicle at the end of the. This buyout amount will include the residual value of your vehicle at the lease's start, your total remaining payments, and possibly a car purchase fee. If you. Locate the Buyout or Payoff Amount listed in your monthly leasing statement. This amount includes the residual value of your vehicle at the start of your lease. Should You Buy Your Lease? · Determine the residual value of the vehicle. · Determine the actual value of the vehicle. · Compare the residual value and the. It is most commonly associated with car leasing. As an example, a car worth $30, that is leased for 3 years can have a residual value of $16, when the. Your monthly leasing statement may display a Buyout Amount or Payoff Amount. This figure typically includes the residual value of your vehicle at the lease's. Put the residual value and the actual value side by side. If the actual or estimated current value is higher than the residual value, then a buyout will be a. Take a look at your monthly lease statement. You may see a buyout amount or payoff amount listed here. This amount includes the residual value of your vehicle. When looking at your monthly statements, you might have noticed "Buyout Amount" or "Payoff Amount" section. This amount includes the residual value of your. How to Calculate Car Lease Buyout & Is it Worth It? · Determine the residual value of the vehicle. · Determine the actual value of the vehicle. · Compare the. Several variables are required to calculate the monthly lease on any vehicle: Buyout the leased vehicle—In most cases, it's possible to do an early buyout. How to Calculate a Lease Buyout in 4 Easy Steps · Find your car's residual value. “Residual value” is how much your vehicle was estimated to be worth at the end. In this "lease versus buy" scenario, you'll typically find that the payments will be lower for the leased vehicle. With a lease, the payments go toward. The “Buyout Amount” or “Payoff Amount” may be listed on your monthly statement. This amount covers the residual value of the vehicle, the remaining payments due. You may see a Buyout Amount or Payoff Amount listed in your monthly leasing statement. This buyout amount includes the residual value of your vehicle at the.

How To Get Money Out Of Robinhood Instantly

Prerequisites of Robinhood Withdrawal · Deposit Wait Time: After funding, it may take up to 5 business days before you can withdraw money from Robinhood. · Trade. {Get Live Assistance}Can you transfer money from Robinhood to bank instantly?@ · 1. In-App Support: Open the Robinhood app, tap the 𝟷-+1-() How to move money between Robinhood accounts. You can transfer money instantly between your spending and your individual investing accounts to use immediately. The Robinhood Gold Card is the only credit card you'll need, and it's exclusively for Robinhood Gold members.* 3% CASH BACK ACROSS THE BOARD. Take money out of your account(s) through loans, withdrawals, payouts, retirement income and distributions. · Set up an electronic funds transfer (EFT) · Set up. Before you can withdraw any crypto from Robinhood, you have to set up your Zengo wallet correctly. Zengo is a next-generation non-custodial cryptocurrency. You may get up to $1, instantly after you initiate a bank deposit into your Robinhood investing or IRA account. Although you may have access to these. Robinhood transfers your money to your bank within days. Robinhood instant transfer option allows for same-day transfers at a small cost for. If the bank that you linked to your Robinhood account is eligible for Instant bank transfers, and you linked your bank account using Plaid, you'll see. Prerequisites of Robinhood Withdrawal · Deposit Wait Time: After funding, it may take up to 5 business days before you can withdraw money from Robinhood. · Trade. {Get Live Assistance}Can you transfer money from Robinhood to bank instantly?@ · 1. In-App Support: Open the Robinhood app, tap the 𝟷-+1-() How to move money between Robinhood accounts. You can transfer money instantly between your spending and your individual investing accounts to use immediately. The Robinhood Gold Card is the only credit card you'll need, and it's exclusively for Robinhood Gold members.* 3% CASH BACK ACROSS THE BOARD. Take money out of your account(s) through loans, withdrawals, payouts, retirement income and distributions. · Set up an electronic funds transfer (EFT) · Set up. Before you can withdraw any crypto from Robinhood, you have to set up your Zengo wallet correctly. Zengo is a next-generation non-custodial cryptocurrency. You may get up to $1, instantly after you initiate a bank deposit into your Robinhood investing or IRA account. Although you may have access to these. Robinhood transfers your money to your bank within days. Robinhood instant transfer option allows for same-day transfers at a small cost for. If the bank that you linked to your Robinhood account is eligible for Instant bank transfers, and you linked your bank account using Plaid, you'll see.

Account security checks may require additional time to make funds available. Instant Transfers typically post immediately but can take up to 30 minutes. Only. To withdraw money from Robinhood, you can go to the Accounts tab and tap Withdraw. You can then select the amount of money you want to withdraw. To achieve this, Signal gives Robinhood a “bank-initiated” score, which Using Plaid Signal has allowed Robinhood to unlock % more in instant funds. Invested funds: If you want to transfer money you've invested, you'll need to sell those investments first. · Unsettled sales: Funds from an investment sale will. If you receive a fractional share of stock worth $10 in your Robinhood account, you can't withdraw the $10 you receive by selling the stock for 30 days. The. If you need to withdraw money from Robinhood immediately, you can use the Robinhood Instant feature, which provides instant deposits and extended trading hours. Robinhood helps you run your money your way. Trade stocks, options, ETFs If you still need assistance, please reach out to us at [email protected] You can only withdraw funds via bank transfer So how to actually withdraw funds from Robinhood? At Robinhood, you can only withdraw your money using a bank. With Instant Deposits, you may get up to $1, instantly after you initiate a bank deposit into your Robinhood account. Although you may have access to these. A pending deposit on Robinhood can take up to five business days to complete. During this time, you will be unable to spend or withdraw these funds. With. Trade+2 you can't immediately withdrawal when selling stocks. Withdraw money from bracelet. 6 upvotes · 6 comments. r/Sparkdriver. I initiated a money transfer out of my Robinhood account to my bank last week. In the final step, I chose the free transfer (takes Robinhood doesn't charge fees to deposit money into your spending or investing account, regardless of the type of account you're transferring from. Withdrawals. With Robinhood Gold, you can get even bigger Instant Deposits—up to $50, depending on your investing account balance and status. That means if you see an. The Robinhood instant deposit limit is set at $1, for standard accounts, up to greater amounts in the case of Robinhood Gold subscribers. With Instant Deposit, you get funds to use in your Robinhood account while your money is on its way from the bank. Some of the most common reasons why you can't. The Robinhood Customer Helpline Number 🗣️ +1-() is available for all your needs. How to withdraw money from Robinhood? Withdraw money from. Please note that you cannot transfer money out of a full-service managed making it simple to receive and use funds immediately. What types of. Instant bank transfer - deposit option lets you deposit money from your bank to your Robinhood account in minutes instead of days with no fees. Check out. Standard bank account transfers can take up to 5 business days after you initiate a transfer from your bank account into your Robinhood account.

What Is Fortune 100

FORTUNE Magazine's annual ranking of the world's largest companies. Best Companies to Work For · Give the gift. The Fortune Global , also known as Global , is an annual ranking of the top corporations worldwide as measured by revenue. The list is compiled. Top 10 · 1. Hilton Worldwide Holdings · 2. Cisco Systems · 3. Nvidia · 4. American Express · 5. Synchrony · 6. Wegmans Food Markets · 7. Accenture · 8. Marriott. CITIC Group United Parcel Service Pfizer Deutsche Post DHL Group Banco Santander PowerChina Nestlé Life Insurance. The Fortune are the top companies within the Fortune , an annual list published by Fortune magazine of the largest U.S. companies. CITIC Group United Parcel Service Pfizer Deutsche Post DHL Group Banco Santander PowerChina Nestlé Life Insurance. The first-ever European edition of the Fortune , ranking companies by revenue. view list · Fortune Fastest Growing Companies Fastest-. There are a lot of things that determine how successful a company is. Fortune focuses solely on revenue to make their list. SO what would be a. The Fortune list serves as a barometer of corporate success and influence in the United States, highlighting the largest and most prominent companies. FORTUNE Magazine's annual ranking of the world's largest companies. Best Companies to Work For · Give the gift. The Fortune Global , also known as Global , is an annual ranking of the top corporations worldwide as measured by revenue. The list is compiled. Top 10 · 1. Hilton Worldwide Holdings · 2. Cisco Systems · 3. Nvidia · 4. American Express · 5. Synchrony · 6. Wegmans Food Markets · 7. Accenture · 8. Marriott. CITIC Group United Parcel Service Pfizer Deutsche Post DHL Group Banco Santander PowerChina Nestlé Life Insurance. The Fortune are the top companies within the Fortune , an annual list published by Fortune magazine of the largest U.S. companies. CITIC Group United Parcel Service Pfizer Deutsche Post DHL Group Banco Santander PowerChina Nestlé Life Insurance. The first-ever European edition of the Fortune , ranking companies by revenue. view list · Fortune Fastest Growing Companies Fastest-. There are a lot of things that determine how successful a company is. Fortune focuses solely on revenue to make their list. SO what would be a. The Fortune list serves as a barometer of corporate success and influence in the United States, highlighting the largest and most prominent companies.

Earning a spot on the list is an important indicator of overall company performance. Companies on the Best list consistently outperform the market and. Slalom has been recognized by Great Place to Work® and Fortune® magazine as one of the Best Companies to Work For®, earning the #12 spot on the list. There are 84 Fortune organizations across nearly every industry offering flexible jobs for you to explore in the FlexJobs database. FORTUNE Magazine's annual ranking of the world's largest companies. Best Companies to Work For · Give the gift. The Fortune is a list of the top public and private companies in the United States ranked by revenue. Fortune generates this list. Top 10 · 1. Hilton Worldwide Holdings · 2. Cisco Systems · 3. Nvidia · 4. American Express · 5. Synchrony · 6. Wegmans Food Markets · 7. Accenture · 8. Marriott. “We are delighted to have earned a place on the FORTUNE Best Companies to Work For list,” said Scott McDonald, President and CEO of Oliver Wyman. The Fortune Global , also known as Global , is an annual ranking of the top corporations worldwide as measured by revenue. The list is compiled. Welcome to the Fortune Best Companies to Work For Store. Logo and Accolade Licensing. Leverage your positive edit with marketing and promotional licensing. Twice as many Fortune companies (34%) returned to the office in as they did in (17%). Seven Fortune companies – including Amazon, Intel, &. The Best Companies prove that employee experience is not only compatible with profitability — it's vital to achieving fiscal goals. The Brand Rankings, Fortune U.S. () - by Fortune. This Fortune Technology company has implemented C3 AI Energy Management to perform detailed interval analysis on thousands of opaque energy-consuming racks. More Stats. Customer service employees see a 34% rise in productivity when using Salesforce. 88% of Fortune companies use at least one Salesforce app. Navy Federal Credit Union again named as a Fortune best Companies to Work For® in In summary, the Fortune companies are some of the most powerful and influential businesses in the world. These companies are industry leaders, with strong. COMPANIES Current View: 6. Current View: Rank Company. Revenues. ($ millions). Profits. ($ millions). 1. Wal-Mart Stores. , Coming in at #30, PwC achieved its highest position in 6 years on the Fortune Best Companies to Work For® list by continuing to foster a culture of. COMPANIES Current View: 6. Current View: Rank Company. Revenues. ($ millions). Profits. ($ millions). 1. Wal-Mart Stores. , Coming in at #30, PwC achieved its highest position in 6 years on the Fortune Best Companies to Work For® list by continuing to foster a culture of.

Low Margin Broker

A margin account is a standard brokerage account in which an investor is allowed to use the current cash or securities in their account as collateral for a loan. Trade your strategy with maximum efficiency and save costs with margin rates as low as %. Margin rates. Margin borrowing is only for experienced traders. Trading Direct offers incredibly low margin rates, bringing quality service and value to the trading business since When choosing a futures broker, don't just look for the lowest margins and highest leverage available. Ask your broker how they manage risk, how they monitor. Rated Lowest Margin Fees 1 by outdoorshop.site Margin rates as low as USD %. Learn More. US Margin Loan Rates Comparison. SyntheticFi does the work in the background to get you the lower interest rates while converting the margin interest payment into capital losses. In some cases, it's possible to get a better rate than what is advertised. So if you are with an existing broker and want a lower margin rate, it's best to. High-volume futures traders may qualify for even lower commission rates, please fill out the survey form to see if you qualify. Trading Direct offers incredibly low margin rates, bringing quality service and value to the trading business since A margin account is a standard brokerage account in which an investor is allowed to use the current cash or securities in their account as collateral for a loan. Trade your strategy with maximum efficiency and save costs with margin rates as low as %. Margin rates. Margin borrowing is only for experienced traders. Trading Direct offers incredibly low margin rates, bringing quality service and value to the trading business since When choosing a futures broker, don't just look for the lowest margins and highest leverage available. Ask your broker how they manage risk, how they monitor. Rated Lowest Margin Fees 1 by outdoorshop.site Margin rates as low as USD %. Learn More. US Margin Loan Rates Comparison. SyntheticFi does the work in the background to get you the lower interest rates while converting the margin interest payment into capital losses. In some cases, it's possible to get a better rate than what is advertised. So if you are with an existing broker and want a lower margin rate, it's best to. High-volume futures traders may qualify for even lower commission rates, please fill out the survey form to see if you qualify. Trading Direct offers incredibly low margin rates, bringing quality service and value to the trading business since

International arbitrage accounts for non-member foreign brokers or dealers who are members of a foreign securities exchange shall not be subject to this Rule. The higher the balance in a margin account, the lower the likely margin rate. So the more you borrow from the brokerage, the less you'll pay in interest for it. Lowest Margin Fees1 by outdoorshop.site Margin rates as low as USD % Learn More. US Margin Loan Rates Comparison2. $ 25K, $ K, $ M, $ M. Discount Trading has really low margins. I have been with them for years and margin for NQ is only $ per contract. Rated Lowest Margin Fees 1 by outdoorshop.site Margin rates as low as USD %. Learn More. US Margin Loan Rates Comparison. Trading Direct offers incredibly low margin rates, bringing quality service and value to the trading business since $0 commissions for online US stock, ETF, and option trades. · Margin rates among the most competitive in the industry—as low as %* · No minimums to open an. The brokerage with the lowest margin rate is Robinhood, charging just % on balances under $50K. Unlike Interactive Brokers, there are no commission fees to. A margin call happens when the account value falls below the broker's required minimum value. When this happens, the broker will require the trader to deposit. AMP Futures provides Super-Low Day Trading Margins. Please view our Futures Margin Calculator List for current day trading, maintenance margin requirements. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. 1. Interactive Brokers: Interactive Brokers is a popular broker that offers low margin requirements for a wide range of assets. They also offer competitive fees. Robinhood Gold offers a high interest rate on uninvested cash and low margin rates. The platform will appeal to traders looking for a low-cost options broker. Interactive Brokers offers low margin loan interest rates. Learn more about margin investing and its benefits and requirements. Optimus Futures offers low day trading margins to accommodate futures Please consult your broker to confirm the current margins for your account at our other. Trade stocks and ETFs with margin rates as low as % and $0 commissions. Leverage your investments for potential higher returns with Moomoo's online stock. Trade stocks & options as low as $ Low margin rates from %. Are you paying your broker too much? Switch your brokerage account today. AMP Futures provides traders Ultra-Cheap Commissions, Super-Low Margins, Excellent hour Customer Service, and a Huge Selection of 50+ Trading Platforms. Low Day-Trading Margins. $50 margins for Micros and $ for E-Minis. Choice icon. No Deposit Minimum and Flexible. There are no additional trading costs, barring swap charges, as the commission is built into the spread. The lowest margin rate with tastyfx is 2%, which.